That is an opinion editorial by Dillon Healy, a member of the institutional partnerships workforce at Bitcoin Journal and The Bitcoin Convention.

A subject that has received increased attention currently is the priority round Bitcoin’s future “safety finances.”

This primarily stems from the concern that miner income is not going to be sufficient to supply ample safety sooner or later, put up block subsidy. Bitcoin miners play an important half in securing the community by proposing blocks of transactions which nodes then confirm, settle for and replace to the Bitcoin ledger. Competing in opposition to different miners to suggest this new block to the chain, miners use intense computing energy to finish the proof-of-work consensus algorithm, and win the correct to suggest the brand new block.

For this service, the successful miner receives a block reward, which is made from two parts: the block subsidy and the transaction charges. The block subsidy is the quantity of latest bitcoin minted in every block (at the moment 6.25 bitcoin), this subsidy of latest bitcoin launched from the full provide of 21 million is lower in half about each 4 years with the halving. The block subsidy at the moment makes up the overwhelming majority of whole miner income.

Simplified, the priority is that the transaction payment portion of the miner rewards is not going to be raised sufficient to make up for the lack of the block subsidy, leading to decreased safety for the Bitcoin community and an elevated chance in assaults as miners are now not incentivized to take part. My view, although, is that the majority who’re frightened about this are misunderstanding Bitcoin’s long-term sport principle, incentive mechanisms, scalability and adoption potential.

With that being stated, this can be a subject that ought to in all probability be mentioned extra publicly and never shrugged off as a non-issue. There are individuals advocating for tail emissions to be added, creating a rise to Bitcoin’s 21 million provide as an answer to the safety finances (settlement finality) challenge, which is regarding.

I imagine the answer (in case you can name it that) is already baked into the Bitcoin incentive construction and adoption curve. There are two elements: one, transaction charges scaling with Bitcoin adoption and as a safety measure and two, Bitcoin mining transitioning to an auxiliary instrument.

Transaction Price Scaling

When this challenge is raised, it normally comes from someone with a misunderstanding of how or why transaction charges will improve or advocating for proof of stake (here’s an example). Sarcastically, one of many causes for elevated transaction charges could possibly be a pure defensive response to an assault from a nasty actor mining empty blocks to forestall customers from transacting. If empty blocks are being mined, the mempool will fill with Bitcoin transactors which can be elevating charges, competing with one another to get within the subsequent block. Riot Blockchain and Blockware Options launched an unimaginable report outlining how this and comparable assaults could be met with naturally-occuring protection mechanisms from the Bitcoin immune system, most leading to a lot greater transaction charges:

“Underneath an empty block assault or different assaults trying to cease customers from transacting, it’s within the self-interest of Bitcoin customers to lift their transactions’ charges to get into the subsequent block. The extra empty blocks (the longer the assault lasts), the extra pending transactions within the mempool. Transaction charges might soar from 1 sat/vbyte to 1,000+ sats/vbyte. The reward for one block might go from near 0 BTC to 10+ BTC assuming the present most block measurement of 1,000,000 vbytes. The system is antifragile, and an empty block assault could be met by an limitless market based mostly counterattack of excessive transaction charges. And data of this counterattack would seemingly deter the attacker from this assault within the first place.”

One other instance of charges elevating on account of the community defending itself could be a response to miners trying to censor retailers. This instance is roofed extra in depth on this article:

“If a majority miner is just not accepting transactions from retailers then the censored retailers should both improve their charges or not transact in any respect. If a service provider can’t transfer their bitcoins then they successfully haven’t any worth for the length during which they’re being censored. We are able to deduce that, on account of private time desire, a service provider who’s being censored shall be keen to pay the next affirmation payment proportional to the length during which they’re being censored, as much as the theoretical most during which the payment is the whole lot of the transaction.”

Along with naturally-occuring defensive incentives that might end in elevated transaction charges, there are additionally numerous arguments for transaction charges growing on account of Bitcoin adoption, particularly as a medium of trade.

As adoption will increase, competitors so as to add transactions to Bitcoin’s scarce block house will improve, and this will increase present charges, which then creates additional demand for scaling options. The market will proceed to current these scaling options as demanded — some standard options now embody exchanges batching transactions, the Lightning Community and different Layer 2 and Layer 3 developments that may finally bundle 1000’s of Bitcoin transfers into one transaction that settles on-chain.

Whenever you perceive Bitcoin’s adoption curve, it’s utterly cheap to imagine that almost all of regular consumer transactions will happen on further layers or sidechains. Last settlement of those extra efficiently-bundled transfers will happen on-chain, together with transactions that need elevated safety or establishments shifting giant values. The ultimate settlement would warrant a a lot greater transaction payment.

The second route that ought to decrease concern round miners dropping offline and lowering the general safety of the community is elevated effectivity and a more moderen realization that Bitcoin miners can act as an auxiliary instrument for different enterprise practices. A highly-overlooked growth within the mainstream currently has been the Bitcoin miners’ incentive to pursue stranded, wasted or extra power.

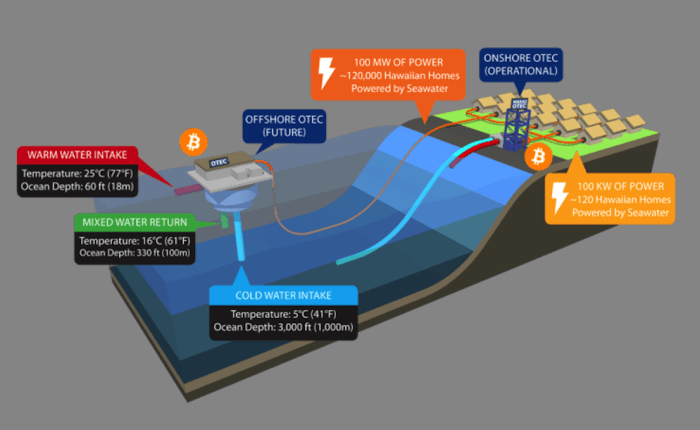

Bitcoin mining provides a novel and new proposal for society, the place untapped or un-transportable power can now be immediately offered to the Bitcoin community on-site by way of mining. One of the crucial fascinating improvements on this sector is ocean thermal power conversion (OTEC) merging with Bitcoin.

There’s an extremely in depth article on how OTEC and Bitcoin can additional power manufacturing and effectivity right here:

“Bitcoin has the potential to assist unlock between 2 to eight terawatts of unpolluted, steady and year-round baseload energy — for one billion individuals — by harnessing the thermal power of the oceans. that turns Earth’s oceans into an unlimited renewable photo voltaic battery.

“It does this by combining heat tropical floor water and deep chilly seawater to create a standard warmth engine. This straightforward concept is completely suited to be expanded to a planetary scale by Bitcoin’s distinctive urge for food for buying and consuming stranded power from the prototypes and pilot vegetation that shall be required to show it really works. Moreover, by harnessing just about limitless portions of chilly water for cooling co-located ASIC miners, OTEC might very effectively be essentially the most environment friendly and most ecological technique to mine Bitcoin.”

This is only one instance of how mining can turn out to be much more environment friendly over time, and with elevated effectivity comes continued community safety because it makes much less sense for miners to go offline.

Bitcoin mining can also be now turning into an auxiliary instrument for different industrial processes. Bitcoin miners can pair with completely different industries and companies and provide monumental advantages to seemingly-normal enterprise practices. One mind-blowing instance: ASICs used to mine Bitcoin generate warmth, this warmth can be utilized to boil water and create steam, condensing the water once more is a type of purification, and finally this may end up in water distillation that was backed by mining, as was mentioned in a current Troy Cross interview.

These ASICs that generate warmth additionally have to be cooled with followers. One other mind-blowing idea is combining mining with companies or industries that naturally create cool air. An instance that Cross mentioned was carbon seize services, which combine monumental fan banks as a part of their regular enterprise operations. Pairing these fan banks with a mining operation subsidizes the price of ASIC cooling.

As these improvements get extra developed, merely including Bitcoin mining to numerous unrelated industries and companies that generate cooling or want heating will enhance effectivity and cut back prices. Bitcoin mining is already heating greenhouses and distilling whiskey, whereas on the identical time monetizing stranded or wasted power.

Over time, Bitcoin mining will proceed to be paired with industries that make mining or regular enterprise operations extra worthwhile. Ultimately it will likely be ridiculous to not use your companies’ naturally-generated warmth or wasted power on Bitcoin miners, or if your online business occurs to have monumental fan banks, it’ll turn out to be ridiculous to not level them at ASICs. All of this ends in extra positively-incentivized miners over time which maintains community safety and has the potential to counterbalance the shrinking block subsidy.

The mix of Bitcoin’s adoption naturally resulting in elevated transaction charges over time and Bitcoin mining shifting into an auxiliary instrument for a variety of impartial industries display how the long-term safety of the community is one thing to be optimistic about.

This can be a visitor put up by Dillon Healy. Opinions expressed are totally their very own and don’t essentially mirror these of BTC Inc or Bitcoin Journal.